What is STAR?

The Share Tracking and Rating (STAR) methods have been developed over some 30 years to provide private investors with a range of structured templates that will enable anyone to set up and manage their own equity portfolios simply, cheaply and easily and without any prior knowledge of the investment world.

The methods of share selection that form the basis of the STAR monthly online updates were originally developed by John Mulligan in order to provide him with an objective approach for managing his own portfolio of UK quoted shares. In the absence of any regular data source that he could use to select and subsequently manage his shares he devised this structured approach to share selection and management.

STAR is a rigorously researched method of regularly re-rating leading shares according to a number of key fundamental criteria and is backed by more than 5000 hours of research. This has involved a detailed study into the relationship between monthly equity earnings and dividend forecasts, since 1985, and the subsequent movement in prices of the relevant shares. The most consistently successful combinations of factors were selected for use in the STAR newsletters. A detailed explanation of the background to STAR is set out in Chapter 9 of the Financial Times/Prentice Hall book on “Smarter Stock Picking” by David Stevenson. Continual evaluation of the STAR methods resulted in the introduction in 2017 of the STAR Series 3 screens that incorporate a number of additional evaluation metrics, as explained elsewhere on this website.

The STAR updates provide a regular monthly investment evaluation on over 450 of the largest UK quoted companies as well as on more than 350 smaller AIM listed companies. They employ methods of evaluating and rating leading UK shares that enable you to select and manage your own share portfolios to suit your own investment objectives and preferences. The monthly newsletters currently contain share selection lists whose objective is to generate capital growth and combined income and growth from main market listed companies as well as growth from smaller and riskier AIM listed shares. Similar STAR portfolios are derived from shares listed on continental European and Global bourses.

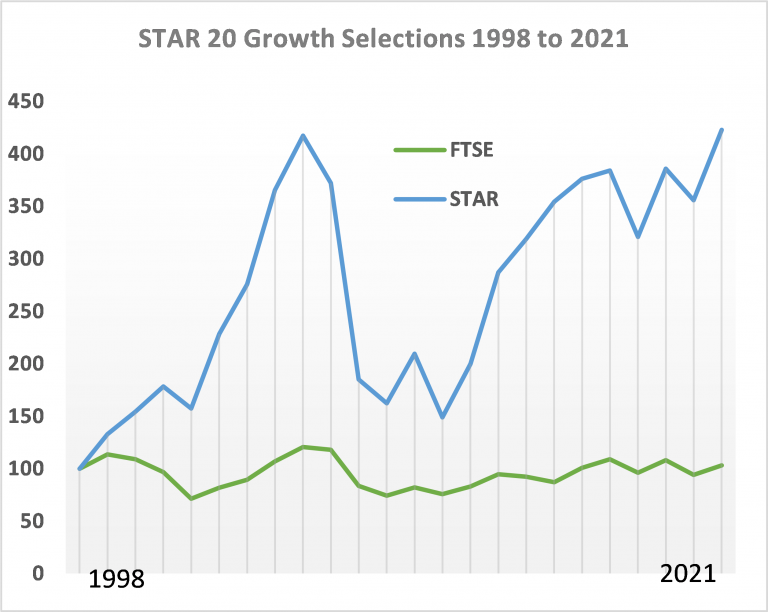

The monthly STAR updates are designed to help in the management of ISA share portfolios and self-invested personal pension plans (SIPPS) as well as conventional portfolios. The methods, which are used to provide regular investment signals for the STAR updates, have been back-tested on a monthly basis since 1985 and published in monthly bulletin form for more than 25 years. Since 1998 the annual selected lists of twenty growth shares had, by September 2021, grown in value, before deducting costs, almost four times faster than the FTSE All Share Index as shown in the chart below:

STAR UK Growth Performance Since 1998

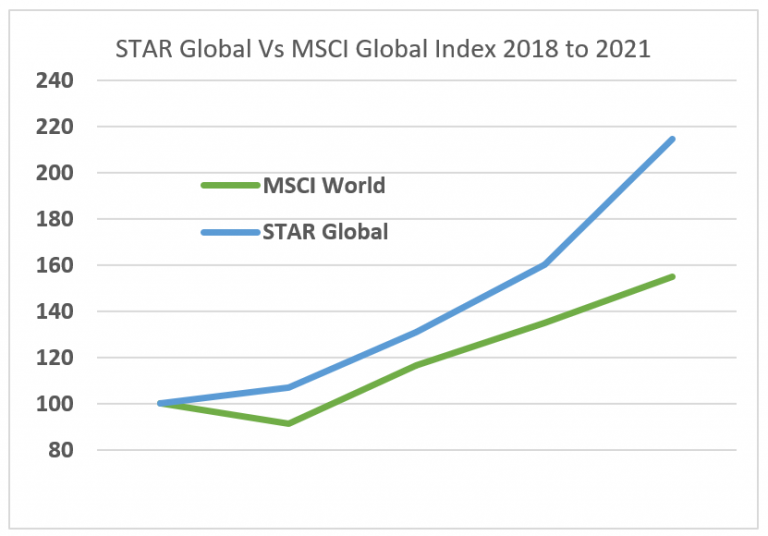

In similar fashion, during the past three years the European and global STAR portfolios of twenty shares have outperformed their respective indices by a significant margin:

STAR Global Growth Performance 2018 to 2021

However, do please remember that past performance on any investment management programme or selection process such as STAR is no guarantee to future success.

One of the main advantages of the methods used for selecting growth shares is that in most years since 1985, relatively few share switches have been signalled during the course of the year.